Investing in real estate in Bali remains attractive due to rising rental demand and continuous infrastructure development. Each area of the island has its unique appeal, attracting investors of all kinds. The first key factors to consider are location and infrastructure. Here’s a detailed description of Bali’s top investment locations.

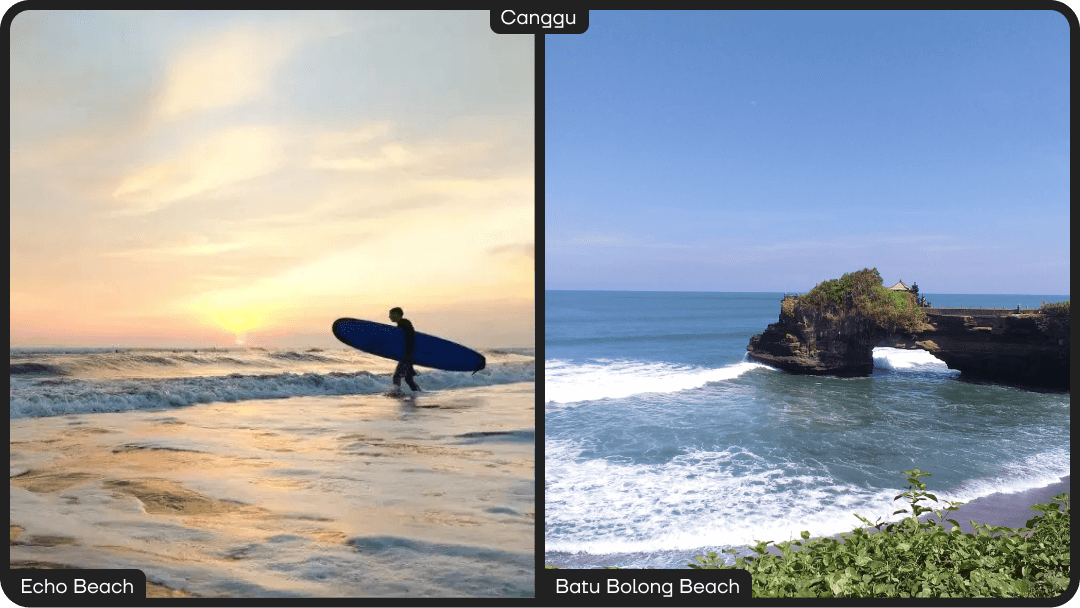

Canggu

Canggu is one of the fastest-growing areas in Bali, popular among both tourists and expats. Known for its beautiful beaches, tropical cafes, bars, and vibrant cultural scene, Canggu has become a focal point for investors, leading to a significant increase in property values.

This area attracts surfers from around the world due to its ideal waves for beginners and experienced surfers alike. Beaches such as Echo Beach and Batu Bolong are especially popular among surfers and beachgoers. Canggu also offers a lively nightlife, with trendy cafes and restaurants serving a variety of cuisines in a relaxed atmosphere.

Benefits for Investors: Canggu has high demand for both short-term vacation rentals and long-term stays, making it a strong investment choice.

Seminyak

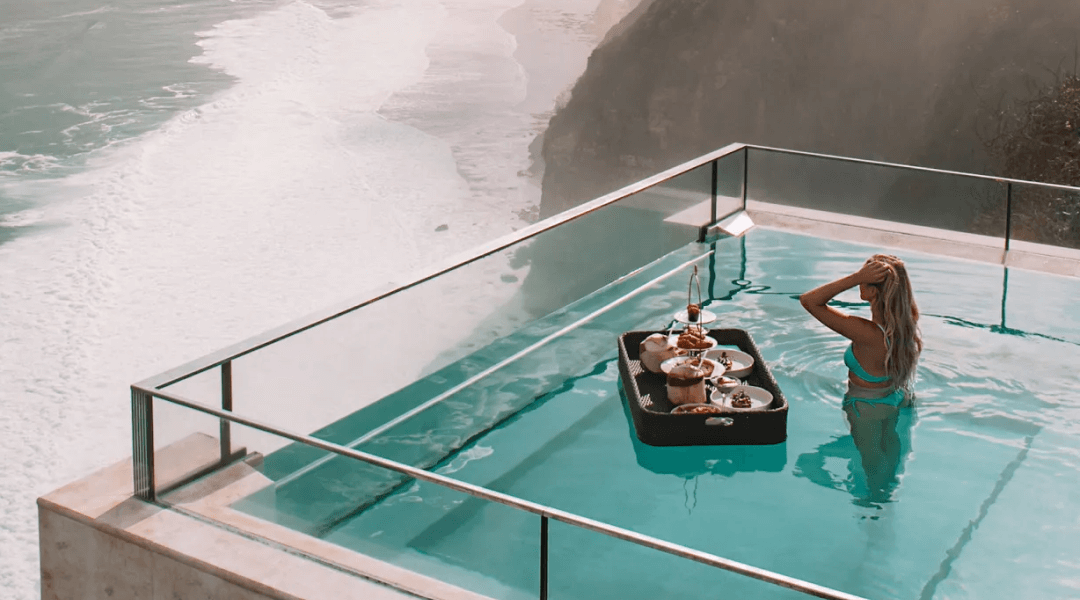

Seminyak remains one of Bali’s most prestigious areas, known for upscale shopping, dining, and stunning sunset beaches. It was one of the first areas to capture international tourist attention and is still popular among travelers and investors.

Property prices in Seminyak are higher than in other areas, but they are justified by high rental rates and stable demand. Villas and apartments are particularly sought after by travelers who appreciate proximity to beaches and access to a wide range of entertainment, including high-end restaurants and nightclubs. Seminyak is bustling day and night, making it perfect for short-term rental investments.

Investment Benefits: Property in Seminyak provides guaranteed rental income, especially during the tourist season.

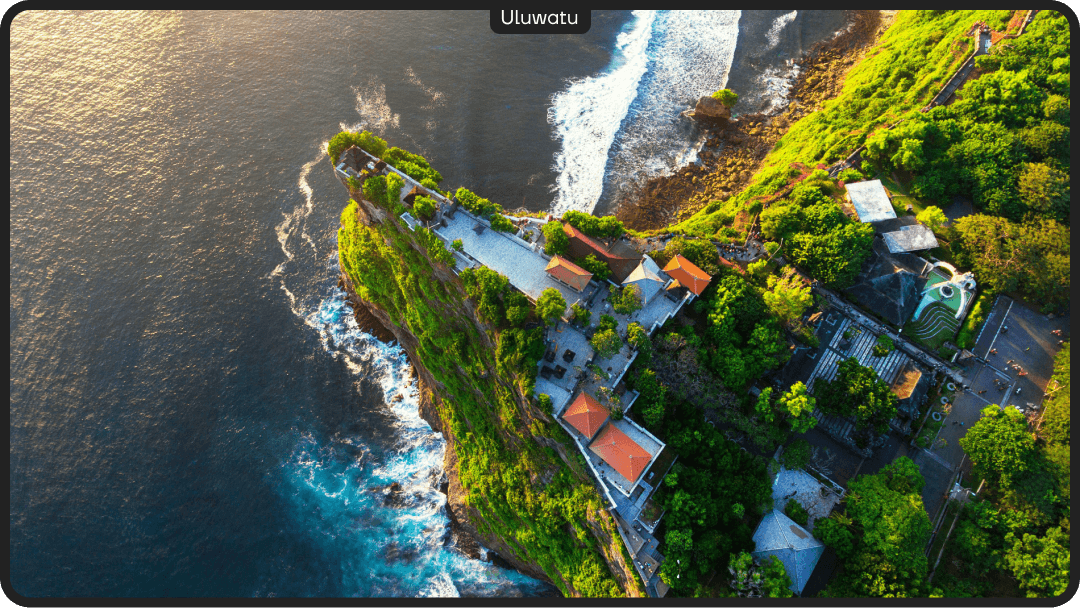

Uluwatu

Uluwatu, located on Bali’s southwestern tip, attracts tourists with its dramatic cliffs, white sandy beaches, and world-class surf spots. Known initially only among surfers, Uluwatu is now becoming a center for luxury real estate, drawing interest from tourists and investors alike.

Development in Uluwatu has accelerated in recent years, leading to a considerable rise in property prices. Major projects for luxury villas and resorts are underway. The area’s natural beauty, distance from crowded tourist zones, and serene atmosphere appeal to those seeking a peaceful place to live or vacation.

Investment Benefits: Uluwatu has stable demand for luxury villas, making it ideal for short-term rentals among travelers and surfers. This area has enormous potential for further development and property value appreciation.

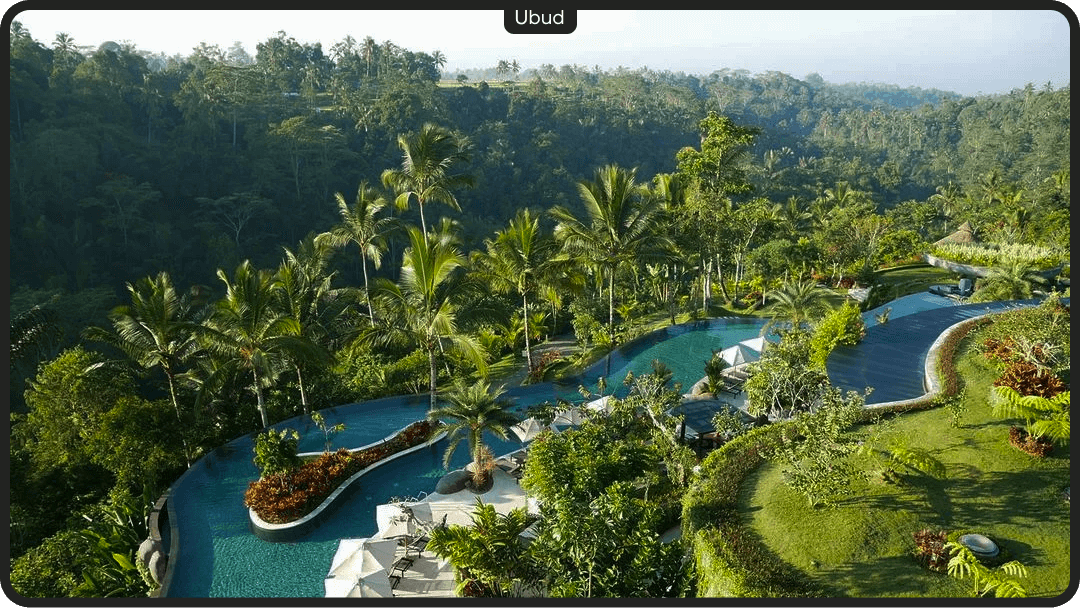

Ubud

Ubud is Bali’s cultural heart, known for its rice terraces, temples, and tranquil atmosphere. It attracts tourists interested in yoga, meditation, arts, and culture. Ubud is ideal for those seeking seclusion and peace away from the bustling resort zones.

Interest in Ubud’s real estate has grown due to an increasing number of tourists and expats choosing this area for long-term stays. Rental demand is stable, especially among digital nomads and wellness tourists, making Ubud attractive to investors. The area offers both high-end villas and more affordable properties, allowing investment options for various budgets.

Investment Benefits: Investors benefit from Ubud’s unique atmosphere, blending natural beauty with traditional culture, which attracts tourists year-round.

Cemagi and Nyanyi

Located northwest of Canggu, Cemagi and Nyanyi are emerging growth areas. Infrastructure development and increasing tourist numbers in these regions create new investment opportunities. Villas and land are more affordable here than in Canggu, yet interest from buyers is growing, leading to rising property values.

These areas appeal to those seeking a peaceful environment and proximity to nature, making them popular for both living and short-term rentals. Investing in Cemagi and Nyanyi today can be a strategically advantageous choice for those anticipating long-term property appreciation.

💸 Evaluating Profitability and Value Growth

Due to high return on investment (ROI) and rental income, many foreign investors prefer to buy villas or land on Bali. Economic growth and rising tourism make Bali land increasingly attractive for investment.

Average Rental Income: Bali’s rental income is influenced by several factors, reflecting notable regional differences. Key factors include location, property type, and amenities. Properties near popular tourist spots or with unique features, such as private pools or ocean views, usually yield higher rental returns. Understanding these factors is essential for investors seeking to maximize rental income.

Rental Income Example:

Consider a Bali property purchased for $250,000 and rented out for $37,500 per year. Gross rental yield = (annual rental income / property purchase price) × 100 Using the figures above: Gross rental yield = (37,500 / 250,000) × 100 = 15%

In this example, we used Bali’s average annual rental income to calculate a gross rental yield, which amounts to 15%.

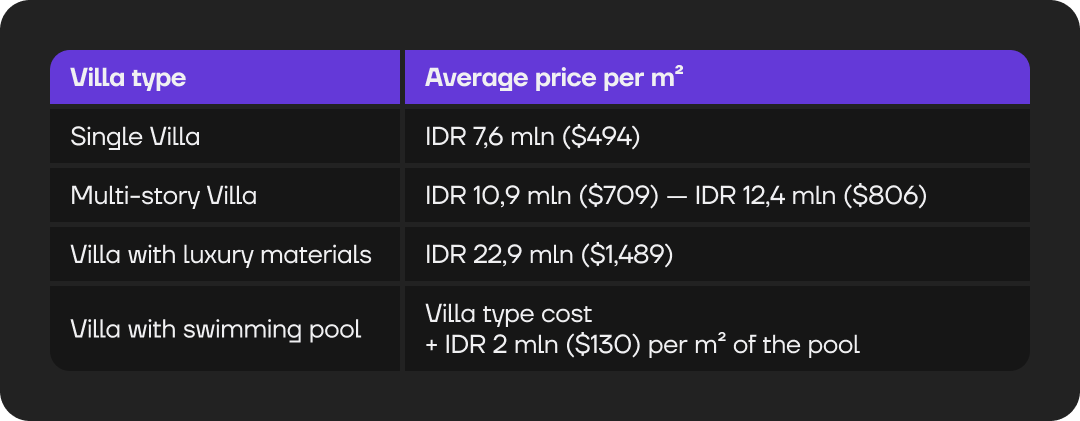

Property Prices in Bali: The cost of property is a key factor in investment. Property size, location, type, and building materials are the main factors determining overall cost.

Return on Investment (ROI) for Villas in Bali: With tourism rebounding after the pandemic, the average ROI on Bali property ranges from 12-20% per year.

Calculating Property ROI: ROI is a profitability indicator expressed as a percentage and can be calculated using the formula:

Consider a Bali property purchased for $250,000 and rented out for $37,500 per year. Gross rental yield = (annual rental income / property purchase price) × 100 Using the figures above: Gross rental yield = (37,500 / 250,000) × 100 = 15%

In this example, we used Bali’s average annual rental income to calculate a gross rental yield, which amounts to 15%.

Property Prices in Bali: The cost of property is a key factor in investment. Property size, location, type, and building materials are the main factors determining overall cost.

Return on Investment (ROI) for Villas in Bali: With tourism rebounding after the pandemic, the average ROI on Bali property ranges from 12-20% per year.

Calculating Property ROI: ROI is a profitability indicator expressed as a percentage and can be calculated using the formula:

For example, a villa purchased for 1.9 billion IDR ($123,500) and sold five years later for 3.2 billion IDR ($208,000) yields a net profit of 1.3 billion IDR ($84,500), resulting in an ROI of 68.4%.

⚠️ Risks and How to Minimize Them

To maximize returns on your Bali property investment, it’s essential to follow some key guidelines throughout the process.

Understanding Legal Ownership: Foreign investors should be aware of Indonesia’s property ownership laws, which differ significantly from those in many Western countries, particularly in terms of ownership rights.

There are two primary forms of property ownership in Bali: freehold and leasehold.

- Freehold (Hak Milik): This is the most common form of ownership in Indonesia, but foreigners cannot directly own freehold property. This restriction often leads foreigners to use alternative methods, such as forming partnerships with Indonesian citizens or using nominee structures. However, these methods carry considerable risks, and the title remains under the name of the Indonesian citizen or nominee.

- Leasehold (Hak Sewa): Leasehold property is a more common and legally straightforward option for foreigners. In this arrangement, an investor leases the property for a set term, usually between 25 and 30 years, with the possibility of extending up to 70 years. This type of ownership is safer for foreigners and beneficial, especially for short- and medium-term investments.

Legal Consultations and Due Diligence: Navigating Bali’s property ownership complexities requires in-depth legal knowledge. Legal advice and due diligence are essential. Foreign investors should work with competent lawyers to ensure compliance with Indonesian law and protect their rights.

At ORBITA, we understand the complexities that foreign investors face when investing in Bali property, which is why we offer legal services to guide our clients through every step.

Investment Goals and Personal Circumstances

Investing for Rental Income: Bali’s thriving tourism industry presents a profitable opportunity for real estate investors, especially in short-term vacation rentals and long-term leases. The island’s popularity among both international and domestic tourists ensures consistent rental demand.

Certain areas of Bali are particularly attractive to tourists and, therefore, rental investments. For example, Seminyak, with its high-end boutiques and vibrant nightlife, attracts affluent visitors. Ubud, known for its serene rice fields and cultural richness, appeals to those seeking peaceful seclusion.

Other areas, like Canggu and Uluwatu, are gaining popularity due to their unique mix of beach life and local culture. Investing in property in these areas can yield substantial returns, especially during peak tourist seasons.

In Conclusion

Acquiring property in Bali offers substantial opportunities for investors due to steady rental demand and infrastructure development. Each area on the island has unique advantages, from prestigious Seminyak and rapidly growing Canggu to peaceful Ubud and elite Uluwatu. When selecting an investment property, it’s essential to consider not only location and infrastructure but also the legal aspects of property ownership in Indonesia.

For a successful and secure transaction, we recommend reaching out to our agency. Our specialists will help you choose the ideal property, provide legal support, and ensure maximum profitability from your investments.